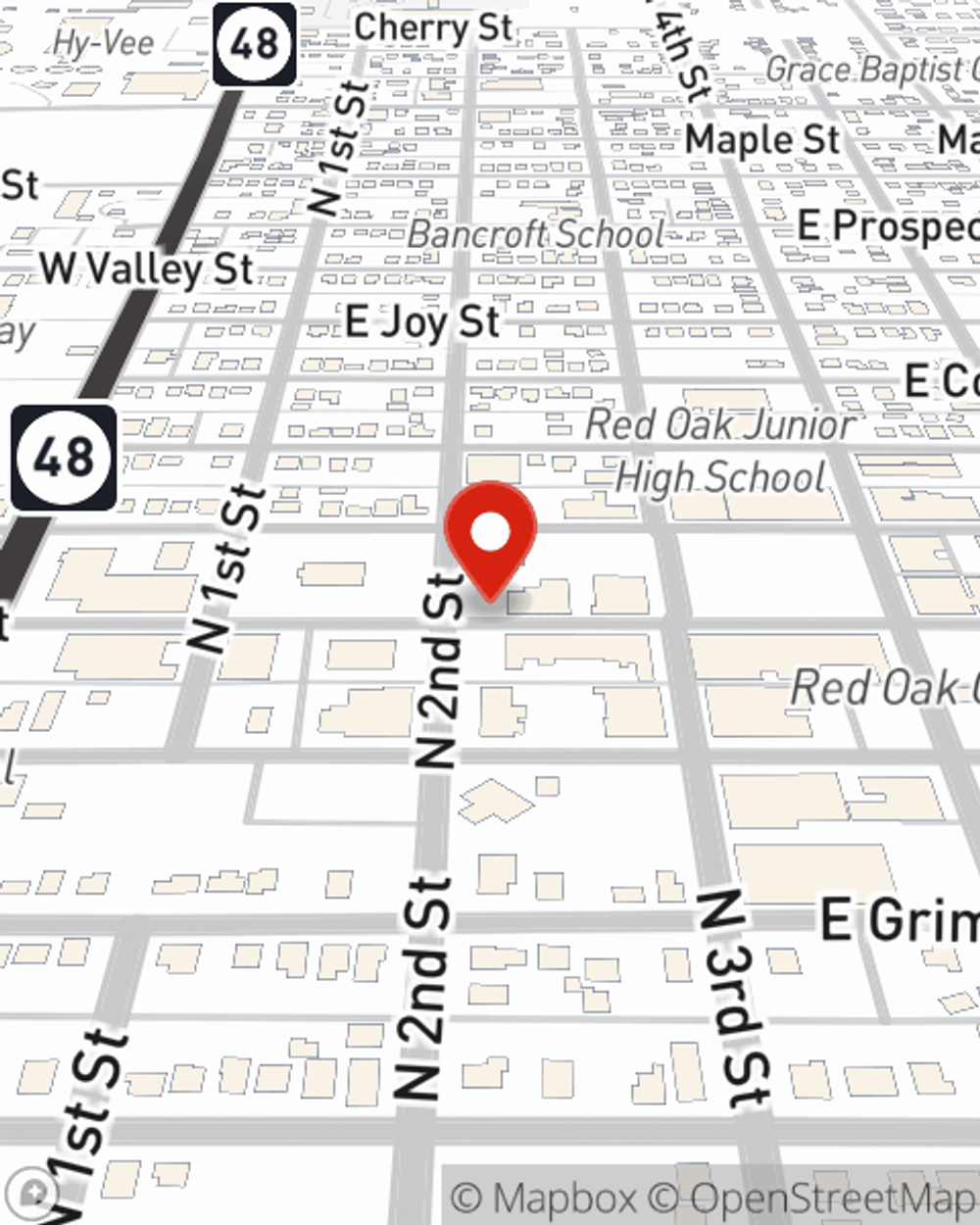

Business Insurance in and around Red Oak

Looking for small business insurance coverage?

Insure your business, intentionally

- Stanton

- Griswold

- Elliott

- Henderson

- Essex

- Villisca

- Malvern

- Corning

- Omaha

- Bellevue

- Council Bluffs

- Montgomery County

- Page County

- Cass County

- Adair County

- Mills County

- Union County

- Douglas County

- Sarpy County

Your Search For Great Small Business Insurance Ends Now.

Whether you own a a toy store, a fabric store, or a home cleaning service, State Farm has small business protection that can help. That way, amid all the various moving pieces and decisions, you can focus on what matters most.

Looking for small business insurance coverage?

Insure your business, intentionally

Strictly Business With State Farm

You are dedicated to your small business like State Farm is dedicated to outstanding insurance. That's why it only makes sense to check out their coverage offerings for builders risk insurance, surety and fidelity bonds or artisan and service contractors.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Dave Carbaugh is here to help you learn about your options. Call or email today!

Simple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Dave Carbaugh

State Farm® Insurance AgentSimple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.